With the entire buzz surrounding cryptocurrencies and its increasing strategic value for businesses, it is only necessary to be familiar with the nuts and bolts at the back of your hand. Before we delve deeper, lets first lay down the foundations of the terminologies that this ever-growing tech field giant encompasses.

- Cryptography: This is the science that studies techniques for scrambling or remolding data in order to disguise it. It secures communication against malicious third-parties (called adversaries). Encryption, that we all know of, is a component of this science.

- Cryptocurrency: In simple words, a cryptocurrency is a digital or virtual currency designed to work as a medium of exchange. It uses cryptography to secure and verify transactions

- Blockchain: This is a digitized public ledger in which transactions are made in cryptocurrency and are recorded chronologically and publicly. Many people see blockchain as an alternative to traditional banking.

- Bitcoin: Bitcoin is a cryptocurrency, a form of electronic cash.

Types of Blockchain:

There are two main types of blockchain; Public and Private. The way that they differ, affect the level of security they provide. The major differences are listed below:

| Public Blockchain | Private Blockchain |

|

|

Benefits of Blockchain:

Although it may seem traditional databases perform better, Blockchain seems to seal the deal with its 4 major advantages:

- Cryptographic Security: The records on a blockchain are secured through cryptography. Network participants have their own private keys that are assigned to the transactions they make and act as a personal digital signature. If a record is altered, the signature will become invalid and the peer network will know right away that something has happened.

- Transparency: The transparency of a Blockchain stems from the fact that the assets and transactions of each public address are open to viewing. It is possible to view a user’s holdings and the transactions that they have carried out. This level of transparency and accountability has not existed within financial systems before, especially in regards to large businesses.

- Decentralization: Blockchains are decentralized and distributed across peer-to-peer networks that are continually updated and kept in sync. Since they aren’t contained in a central location, Blockchains don’t have a single point of failure and cannot be changed from a single computer. This makes hacking considerably difficult.

- Immutability: Lets understand this term with a comparison. In Excel spreadsheets, you can add rows, add columns, delete rows, edit data, etc. In other words, Excel is mutable. Blockchain on the other hand, are immutable; once a piece of information is written to a block, it can never change.

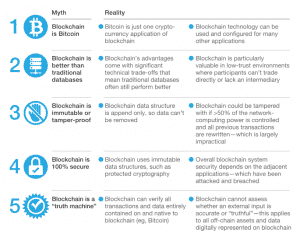

The picture below summarizes the basic facts and confusions surrounding Blockchain*:

*McKinsey & Company Insight

I hope this article gave useful information in an easy to understand manner. For more in-depth articles, hit us up with a comment and we’ll make sure to post about it!

That was so condensed yet informative. Thanks for this brilliant article. Good job!

Most welcome!